Betting Big? NC Tax Collectors Have Their Eyes on Your Sports Winnings

="> Carolina Sports Betting Tax Tax: landscape: A Closer Look at Potential Changes

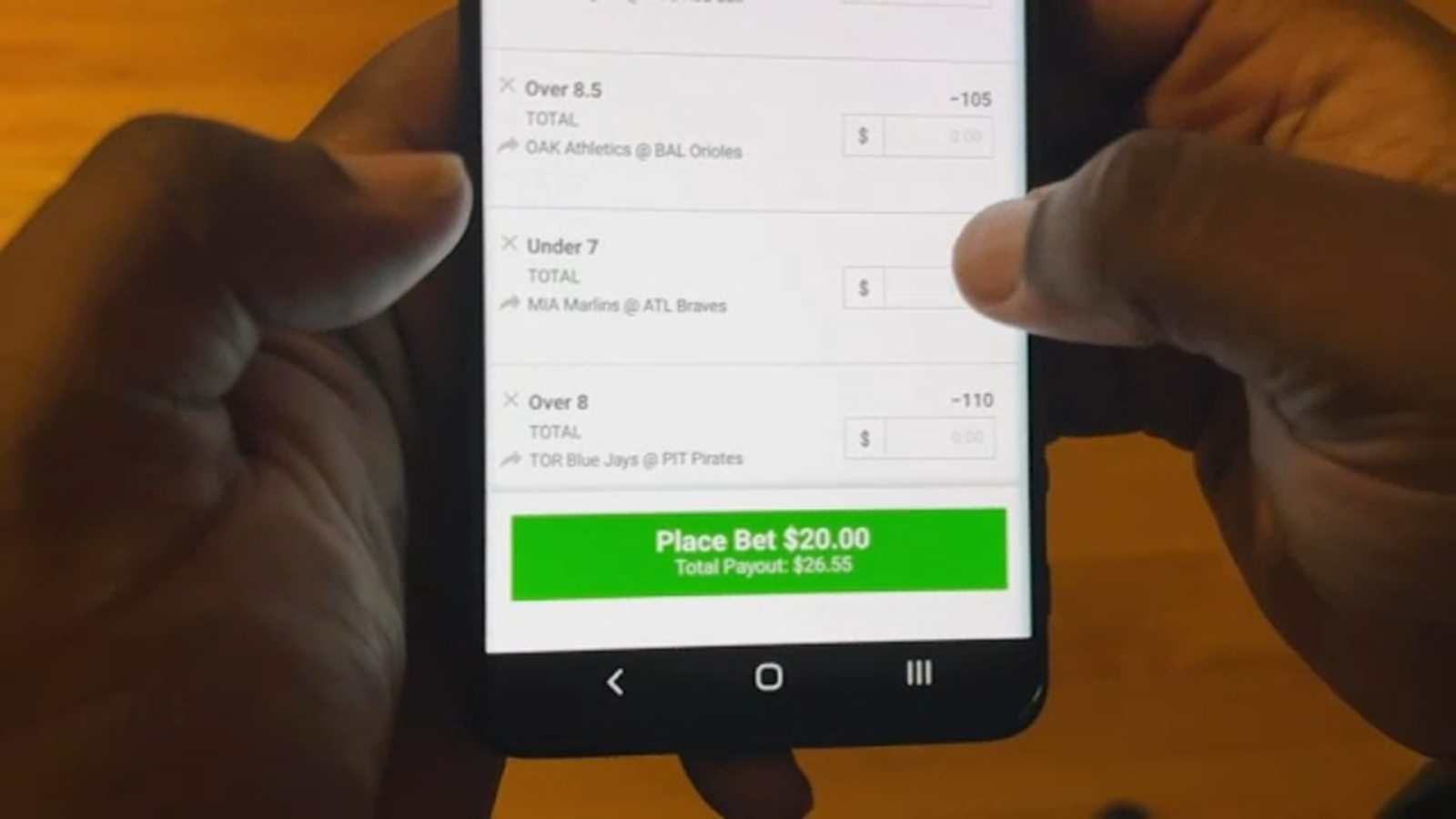

, bettingors in North Carolina Carolina face a challenging tax reality: winnings from sports betting sports betting apps require require full state tax payment without potential loss dedeductions. A However, a proposed bill under consideration review might soon transform this taxation framework, potentially allowing betters to offset to offset their their their winnings - providing financial relief for passionate sports betting enthusiasts..ors.state.

The proposed legislation potential legislative modification could significantly significantly impact the sports betting betting ecosystem, more favorable tax treatment for recreational and professional sports betting betting enthusiasts. By providing potential tax relief mechanisms that acknowledge both winning and losing scenarios scenarios within sports betting environments.Stay tuned for further for potential updates on this emerging emerging sports betting tax taxation legislative development in North Carolina Carolina's evolving sports betting landscape betting regulatory framework.